Alternative Protein Funding Down by 50% in the First Half of 2025

)

Alternative proteins haven’t had the same pull with investors as they did at the turn of the decade, and the consistent downturn in funding has reached a new low in 2025.

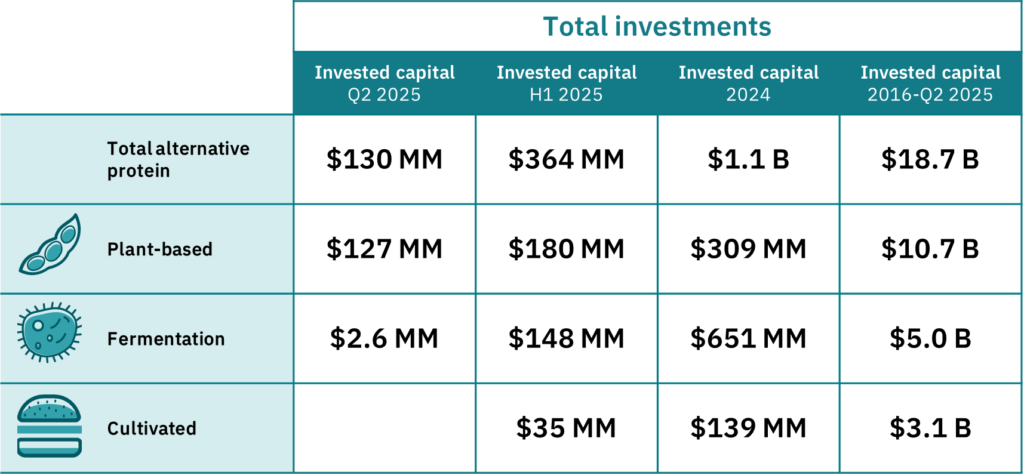

In the first six months of this year, funding for plant-based, fermentation-derived and cultivated proteins fell by 49% compared to the same period in 2024, according to the Good Food Institute’s (GFI) analysis of data from Net Zero Insights.

This is after alternative protein companies raised just $129.5M in Q2, a 45% decline from the previous quarter. It took total funding for the first half of 2025 to $364M.

Courtesy: GFI

Graphic by Green Queen

Unlike recent quarters, where fermentation companies have gone the opposite way of the otherwise declining trend, they only raised $2.6M in Q2 (down from $146M in Q1). And while there were three investments announced for cultivated meat, the amount of each deal remained undisclosed.

Plant-based food companies received $127M in the April to June period. However, a large chunk of that was thanks to Beyond‘s $100M debt financing deal. Without this, the plant-based category would have received just half of its Q1 total in this period.

AI a threat and an opportunity for alternative protein funding

Graphic by Green Queen

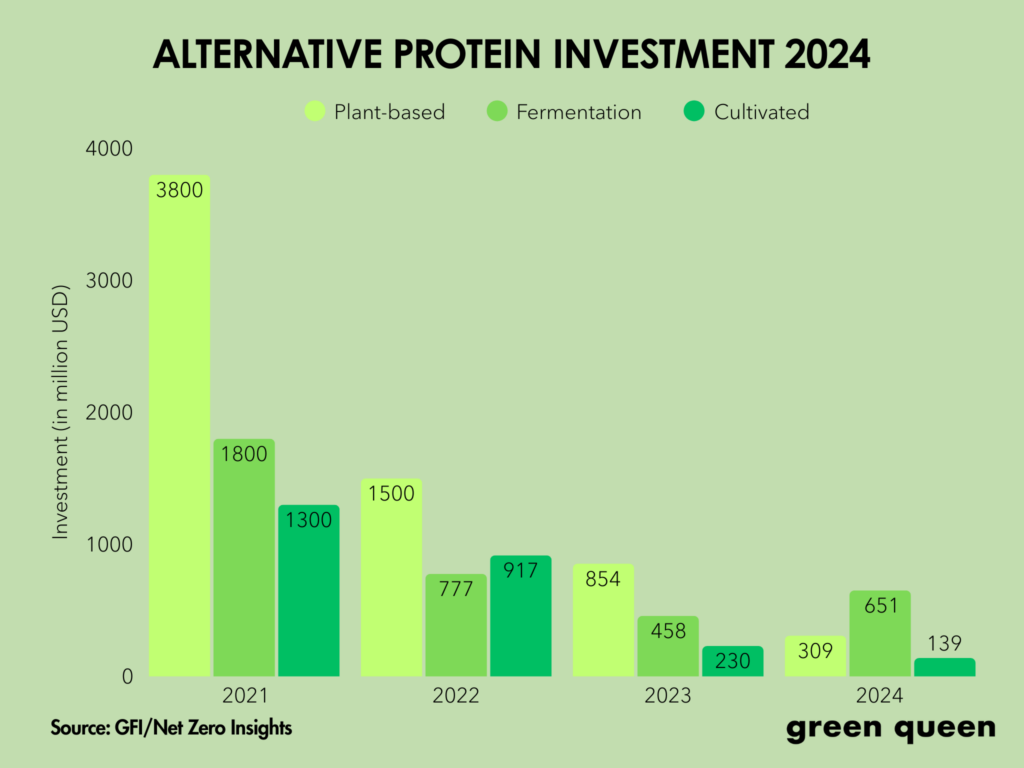

For context, investment in the future food sector has been slowing for a few years now. After attracting nearly $7B in 2021, there has been a constant drop, to $3.2B in 2022, $1.5B in 2023, and $1.1B in 2024.

The trend was already worsening in Q1 2025, when alternative protein investments declined by 28% year-on-year. But the subsequent performance in Q2 has left more questions for the sector for the rest of the year.

VCs, in general, are a conscious class right now. It’s not just this sector that has seen a downward trend in funding, agrifood tech (a 37% year-on-year decline), biotech (-35%) and climate tech (-19%) have all suffered similarly.

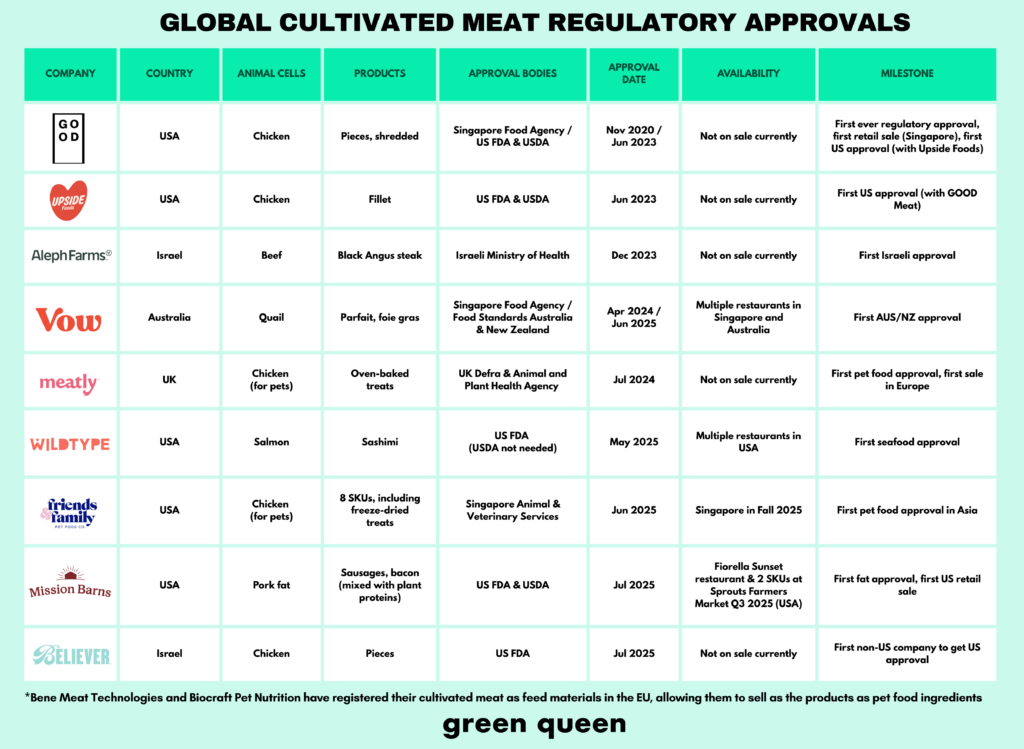

With alternative proteins, the hesitance in investing stems from a range of factors, including geopolitical uncertainties, President Donald Trump’s tariff war, Robert F Kennedy Jr’s MAHA policies, the constant attacks on ultra-processed food, legislative bans on cultivated meat, and a resurgence of animal proteins amid continued sales declines for plant-based proteins in several markets.

“Recent investment levels in alternative proteins reflect a market-wide slowdown in food and climate tech funding, driven in part by the reallocation of investor capital toward artificial intelligence,” Daniel Gertner, GFI’s lead economic and industry analyst, told Green Queen.