BEVERAGES

YOUR GATEWAY TO HIGH-GROWTH BEVERAGE OPPORTUNITIES

Driven by soaring global demand for healthier, more sustainable, and experience-led products, the beverage industry is entering a major new phase of growth.

The Beverage sector at Gulfood 2026 returns at its largest scale yet, with an expanded footprint, greater diversity, and unmatched international participation. It is the definitive marketplace for anyone serious about doing business in beverages.

The entire ecosystem comes to life here. From bottled water, juices, energy drinks and dairy alternatives to speciality coffee, tea and craft drinks, this is where brands, technology leaders and solution providers converge. Visitors can explore next-generation formulations, AI-powered production, smart packaging breakthroughs and rapidly growing global markets.

Gulfood 2026 offers a front-row view of how innovation, wellness and sustainability continue to redefine the beverage industry. Don’t miss it.

POWERED BY OUR BEVERAGE SPONSORS

📍 EXPERIENCE IT LIVE AT

Za’abeel Halls, Dubai World Trade Centre

Take the Metro Red Line and stop at World Trade Centre Metro Station. From the station exit, follow the signs toward Dubai World Trade Centre (DWTC) and enter through the Convention Gate.

Once inside, walk through the main concourse that connects the exhibition halls. Continue straight ahead following the overhead signs directing you to the Za’abeel Halls. The walk takes approximately 5 to 10 minutes from the metro station and is entirely covered and air-conditioned, ensuring easy and comfortable access.

For visitors arriving by car or taxi, follow signs for Za’abeel Parking at DWTC for direct access to the halls.

CONNECT WITH

BEVERAGE POWERHOUSES

FROM EVERY CORNER OF THE WORLD

ITALY

SPAIN

GERMANY

AUSTRIA

TURKEY

INDIA

FRANCE

THAILAND

BRAZIL

UNITED KINGDOM

CHINA

JORDAN

EGYPT

TAP INTO THE BEVERAGE WORLD'S MOST

STRATEGIC CONNECTIONS

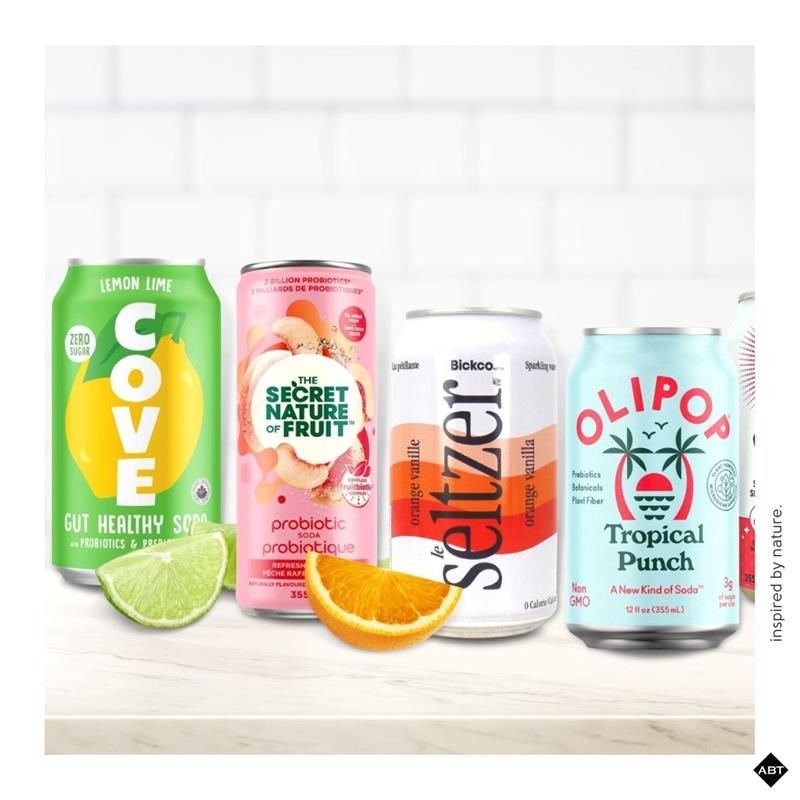

SOURCE A GLOBAL RANGE OF IN-DEMAND BEVERAGE PRODUCTS

ALL IN ONE-PLACE

STRATEGIC TRENDS RESHAPING THE BUSINESS OF BEVERAGES

LATEST NEWS & INSIGHTS MOVING THE BEVERAGE INDUSTRY

)

)

)